How to resolve the Past Due validation

In the event the validation Past Due is triggered for an invoice, you can resolve it by completing the following steps.

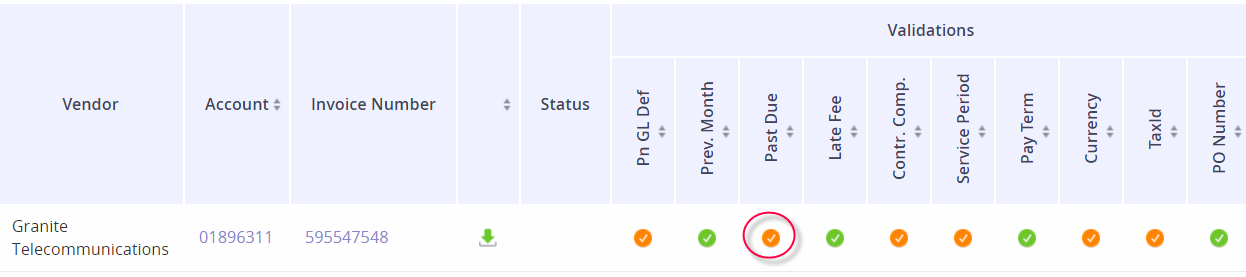

Click on the triggered icon under the Past Due column.

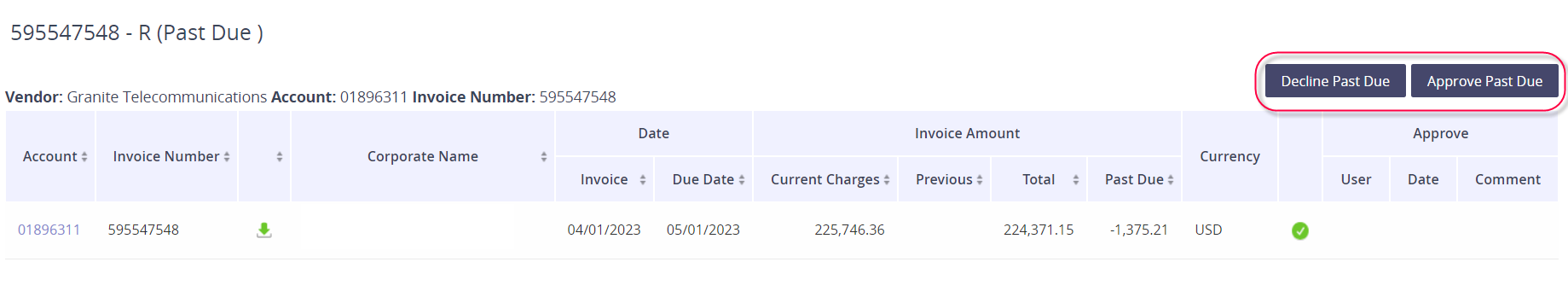

Review the invoice amounts and the past due amount.

Determine if the past due amount is valid.

If the past due is valid and you need to pay the amount, click the button Approve Past Due.

If the past due is invalid, click the button Decline Past Due.

Why would a Past Due be valid?

Previous payments were delayed, resulting in rolling late fees

Previous payments were not issued and therefore the vendor did not receive payment

Why would a Past Due be invalid?

The vendor has mis-applied the payment

The previous amount due was paid to the vendor, but did not post until after the invoice was generated and sent out

You are disputing charges and short-paying the account until the dispute is resolved

You may want to research the payment history of the invoice before actioning this validation. You can review the invoice history in Archive or confer with your AP Department to see when checks were issued and the check amounts.